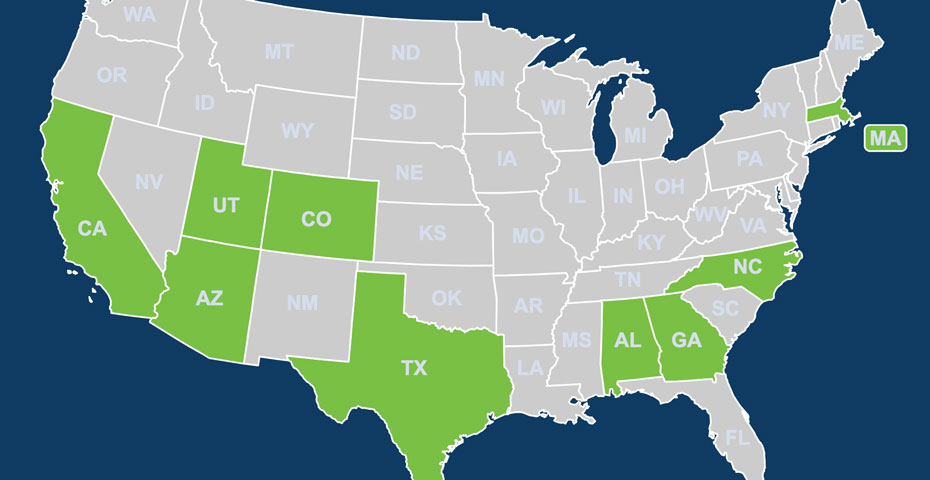

Why Building Multifamily Housing in Texas Makes Sense

Developers looking for a competitive advantage in multifamily housing construction should consider Texas, where building costs are significantly lower and timelines substantially shorter compared to states like California. According to a comprehensive analysis by RAND, multifamily housing construction in California is more than twice as expensive as in Texas. Specifically, the cost in California is … Read more